Natural Gas Power Generator Feed Gas Btucf

Introduction

The role of hydrogen in eliminating CO2 emissions, particularly from the electrical grid, has attracted increasing interest, with potentially significant implications for investors in the natural gas, utility, and industrial equipment spaces.

Institutional investors, e.g. the Climate Action 100+ investors group representing $47 trillion in assets, are increasingly including environmental factors in their investment criteria.

This idea is often expressed as part of a "net-zero carbon grid by 2050" goal for utilities, for example discussed for Duke Energy (DUK) here, where hydrogen is identified as a candidate fuel to generate up to 30% of Duke's power in 2050.

A more ambitious goal for a "net-zero carbon economy" envisions the elimination of fossil fuels not only for power generation, but also for industrial heating, commercial and residential space and water heating, and transportation. This scenario would add additional loads on the electrical grid; for example, residential winter heating requirements now met by natural gas.

In this article, we are going to focus primarily on the net-zero carbon grid issue; can and will hydrogen replace natural gas for the U.S. electric grid? We will also concentrate on the most likely scenario, the use of utility scale solar power to generate hydrogen by electrolysis.

We discuss technical feasibility, operational and economic practicality, and some implications for investors.

Investment Thesis

The investment thesis we will look at today is simple: green hydrogen generated from renewable energy can provide grid scale energy storage similar to that provided today by natural gas - the ability to store very large amounts of energy for days to months. This will overcome the intermittency limitation of wind and solar power and allow replacement of natural gas for power generation, yielding a net-zero carbon electrical grid.

There will likely be significant investment in hydrogen for applications other than grid power generation; the potential overall economic footprint is significant.

The Hydrogen Council estimated $2.5 trillion in worldwide annual sales by 2050, half from hydrogen, half from equipment. In October 2020, the Fuel Cell and Hydrogen Energy Association, focusing on transportation and industrial feedstocks rather than grid power generation, estimated $750 billion in annual U.S. revenue from the hydrogen economy by 2050.

As they say, big if true.

Hydrogen 101

To discuss the potential for hydrogen in power generation, there are a few things we need to keep in mind.

Hydrogen is described as grey, blue, or green depending on how it is made; gray from fossil fuel with CO2 emission, blue from fossil fuel with CO2 captured, and green from renewable energy with no CO2 emissions. When people speak of the future hydrogen economy, or zero-carbon economy, green hydrogen is usually implied.

Hydrogen (H2) is lighter than air gas. One thousand cubic feet (MCF) of hydrogen at standard conditions weighs 2.41 kg or 5.3 lbs; this is about 15% of the weight of natural gas (i.e. methane, CH4).

The energy content of gas is measured in BTUs per cubic foot. Hydrogen has about 30% of the energy content of methane. That means it takes about 3.3 CF of hydrogen to deliver the same energy as 1 CF of natural gas.

To produce hydrogen by electrolysis, 39.4 kWh of input power is required to produce one kg of hydrogen, if the electrolysis process is 100% efficient.

Hydrogen costs may be quoted in $/kg or $/MMBtu. A price of $1/kg is equivalent to about $8/MMBtu. Natural gas is normally priced in $/MMBtu (e.g. at the Henry Hub).

When hydrogen is burned to produce power, no CO2 is produced.

It is possible to mix hydrogen and natural gas in the fuel stream, with a reduction in CO2 output, but because of the difference in energy content, to achieve a 50% reduction in CO2 requires about 75% H2 by volume.

Hydrogen has handling and safety issues that methane does not. Hydrogen can cause embrittlement of metals, and deterioration of plastic and rubber seals.

Technical Feasibility

For the hydrogen thesis to succeed, hydrogen must be generated, transported, stored, distributed, and combusted. Can we practically and safely handle hydrogen? Is this all still just in the lab? Could we technically do this?

All of these steps are in routine operation on an industrial, if not yet grid, scale - with one exception. Hydrogen generation via electrolysis is routine, but still on a less-than-industrial scale (we'll come back to this point).

Industry has decades of experience in generating and handling hydrogen. Worldwide annual production of hydrogen is about 70 million metric tons (MMT); U.S. production is about 10 MMT. Almost all of this production is grey hydrogen.

The first underground salt dome hydrogen storage facility was opened in Texas in 2007, to supply refineries and chemical plants in Texas and Louisiana via a 310 mile pipeline. Two additional underground storage facilities are now in operation in the U.S., with 1600 miles of hydrogen pipelines.

Hydrogen has been added to the fuel mix for gas turbines for decades, accumulating millions of operating hours with up to 50% hydrogen. The primary turbine vendors - Mitsubishi Power (MHI), GE (GE), and Siemens (OTCPK:SEIGY) - all expect to provide turbines to burn 100% hydrogen.

The H21 Leeds City Gate Project is a planned large scale demonstration project to use blue hydrogen to replace natural gas for heating and cooking for 1% of the U.K. population by 2030. There are about 350 pages of detail at the link, down the level of replacing gas appliances.

There are multiple small scale demonstrations of generation and storage of hydrogen, with power generated from fuel cells. One interesting demonstration in the French Alps has been on line for 5 years, where solar power generated hydrogen is stored to provide up to 16 days of power.

Overall, I'd assess it as technically feasible.

Economic Practicality

Estimates vary, but the cost today for hydrogen produced by electrolysis is in the range of $4-6/kg, which works out to about $32-48/MMBtu. Estimates from multiple sources (e.g. the DOE here) suggest that with industrial scale manufacturing of electrolysis equipment, a $1/kg cost may be achievable, i.e. $8/MMBtu.

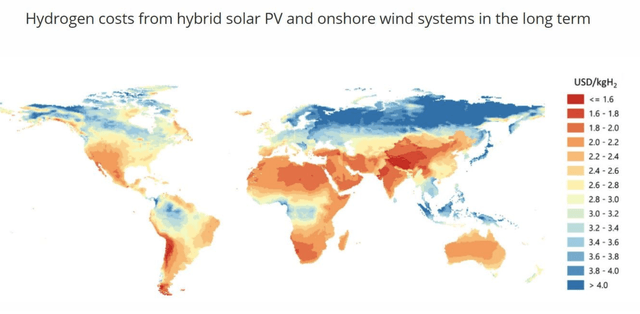

There is an analogy between the cost of hydrogen at the point of production, and the cost of natural gas at the wellhead. In both cases, there is a transportation cost to get the gas to a storage and distribution point, and then on to the point of consumption. The International Energy Estimate below includes transportation.

Source: IEA - The Future of Hydrogen - 2019

Bloomberg NEF estimates that

renewable hydrogen could be produced for $0.8 to $1.6/kg in most parts of the world before 2050. This is equivalent to gas priced at $6-12/MMBtu ... When including the cost of storage and pipeline infrastructure, the delivered cost of renewable hydrogen in China, India and Western Europe could fall to around $2/kg ($15/MMBtu) in 2030 and $1/kg ($7.4/MMBtu) in 2050.

Natural gas prices at the Henry Hub have run ~ $3/MMBtu in recent years. It's a business judgement, but I suspect a preference for green energy isn't enough to overcome a 10x cost premium for hydrogen, but it may well be enough to overcome a 2-3X cost premium. Add a carbon tax into the mix, and the natural gas cost advantage might be made to disappear by 2050.

With a willingness to pay that 2-3x preference premium, I'd assess economic feasibility by 2040 or 2050 as likely, with the caveat that achieving those prices would require grid relevant scale up and deployment. And that would probably depend on having two or three GW size power plants burning hydrogen by 2030. We will look out one potential example below.

Niche applications might be less price-sensitive. Utilities sign purchase power agreements (PPA) today for solar power knowing that the power can only be delivered during daytime hours. They might pay a premium price for a PPA that could reliably deliver power at night.

Operational Practicality

The question here is can we do this in the real world, at grid scale?

Let's look at hydrogen generation first. Steam methane reforming accounts for about 95% of hydrogen production today. This method generates 5.5 kg of CO2 per kg of H2, so is not attractive for zero-net carbon goals in the absence of cost effective carbon capture. And given cost effective carbon capture, it's easier to just generate grid power directly with natural gas.

Electrolysis

Electrolysis is expected to be the future hydrogen production method of choice. This is sometimes termed Power-to-Gas (P2G). In electrolysis an electric current applied to water breaks the water molecules apart and generates hydrogen and oxygen gases: H2O + power -> H2 + O2.

Nine kg of water is required to produce one kg of hydrogen. If the electrolysis process is 100% efficient, 39.4 kWh of input power is required to produce one kg of hydrogen.

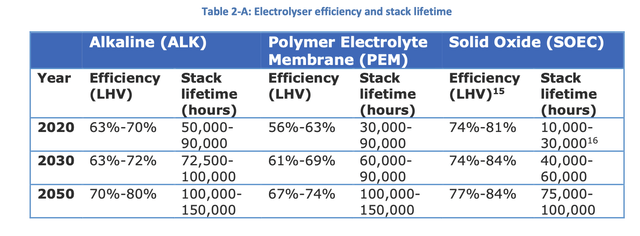

Source: EU - Hydrogen Generation in Europe - July 2020

Current commercial electrolysis processes efficiency estimates fall in the 56-81% range, 2050 maximum estimates in the 74-84% range. Stack lifetimes of ~ 10+ years are projected.

Supporting the figures above, NREL estimates for a 2040 50,000 kg/day PEM electrolysis plant suggest 77% efficiency (and a levelized cost of about $4.50/kg).

For our back-of-the-envelope purposes, I'm going to assume at least one of these technologies will reach grid scale, and I'm going to use 80% efficiency in the calculations below. At 80% efficiency, 49.3 kWh of input power is required to produce one kg of hydrogen.

This power requirement figure may be overly generous, in the sense that it doesn't include any energy consumed outside the electrolysis cell.

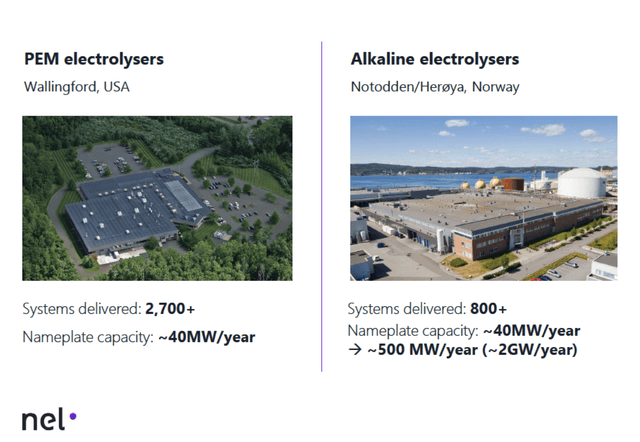

Electrolysis equipment is currently provided by several relatively small companies, for example: Nel ASA (OTCPK:NLLSF), ITM Power (OTCPK:ITMPF), Enapter (private), Sunfire (private). ITM Power is building a 1 GW annual PEM capacity plant in the U.K. A product spec for an ITM Power 10 MW unit producing 4,000 kg/day of hydrogen is available here.

Nel's PEM annual capacity is 40 MW, and ALK capacity is being expanded to 500 MW.

Source: Nel Q3 2020 Investor Presentation

As we will see, these companies would have to grow by orders of magnitude to meet grid demands.

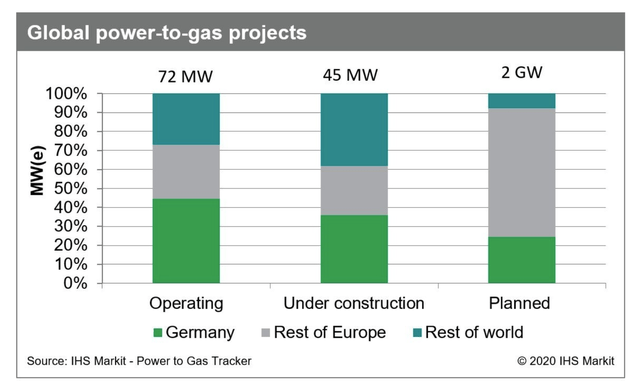

Germany has about 45% of worldwide installed power to gas electrolysis capacity with 34 projects. Note the tiny capacity in grid terms.

Source: IHS Markit

Hydrogen For One Generator

Let's look at hydrogen for one gas turbine.

Consider the widely deployed GE 9F.04 gas turbine, which produces 288 MW of power. With 100% hydrogen fuel, GE (GE) states that this turbine would use about 9.3 million CF or 22,400 kg of hydrogen per hour. With an 80% efficient electrolysis energy cost of 49.3 kWh/kg, producing that one hour supply of hydrogen would require 1,104 MWh of power for electrolysis.

To generate the hydrogen to run the turbine for 12 hours (~ dusk to dawn) would require 12 x 1,104 MWh, or 13.2 GWh. Given a typical 20% solar capacity factor, that would require about 2.6 GW of solar nameplate capacity dedicated to generating the hydrogen to fuel this 288 MW generator overnight.

As a real world example, to replace the 2240 MW per hour dawn to dusk output of California's Diablo Canyon nuclear power plant (scheduled for 2025 retirement), it would take 8 of these turbines with hydrogen generation powered by 20 GWs of solar panels.

How Much Natural Gas Does the Grid Use?

How much hydrogen would it take to fully displace natural gas in electrical power generation in 2050?

According to the Energy Information Agency, the U.S. consumed 31 Trillion CF of natural gas in 2019, or 85 BCF per day. About 36% was used for electrical power generation, i.e. 30 BCF per day.

Source: EIA

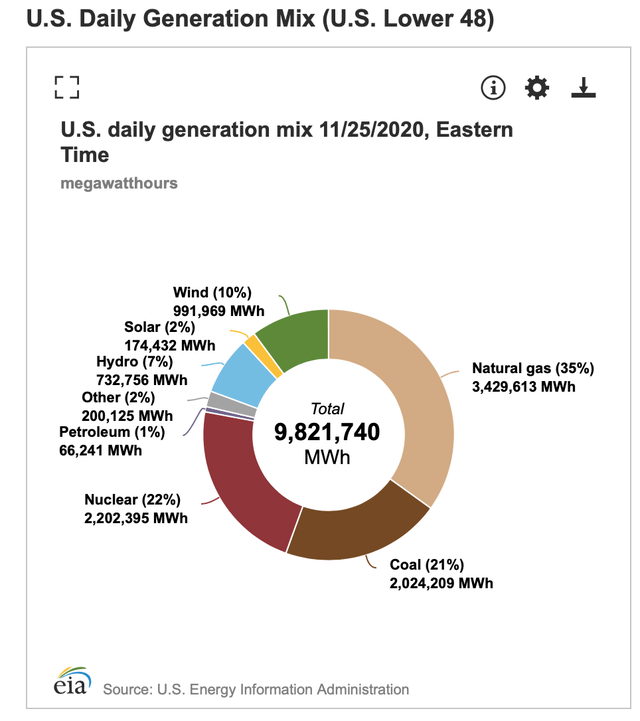

Natural gas currently generates 35% of U.S. electrical power. Here's an actual generation snapshot for 25 November 2020.

Source: EIA Hourly Electric Grid Monitor

Natural gas consumption will probably change between today and 2050. It will increase as it continues to replace coal, decrease as more solar and wind come online, potentially increase as transportation and other areas are electrified.

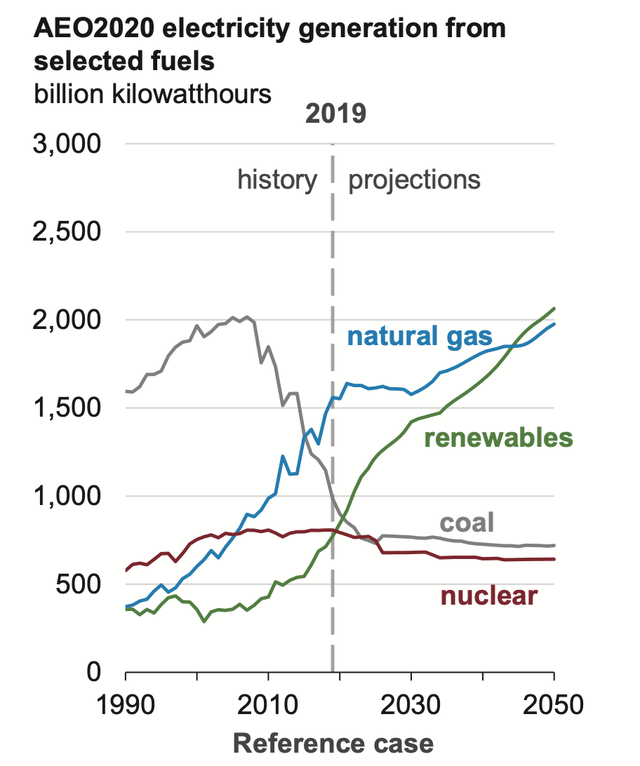

The EIA 2020 Annual Energy Outlook reference case predicts that natural gas will generate about 30% more electricity in 2050 than today. Under the most natural gas adverse EIA scenario, it would decline by about 30%.

Source: EIA 2020 Annual Energy Outlook

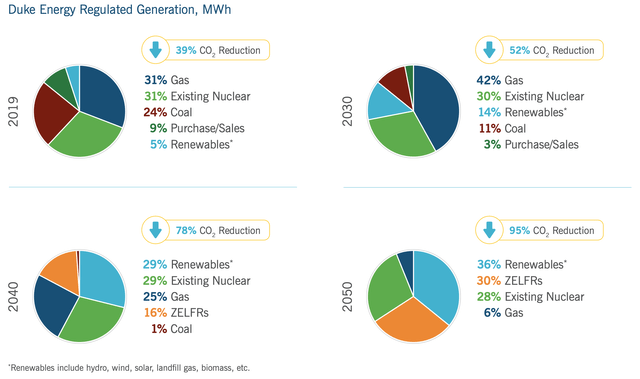

A bottom-up analysis by Duke Energy shows similar trends with today's 31% changing to 6% gas and 30% ZELFR by 2050 (ZELFR is new technology - hydrogen, natural gas with carbon capture, or new nuclear); see this SA article for a more detailed discussion of Duke Energy's plans.

Source: Duke Energy

Hydrogen to Replace Natural Gas for the Grid

For our back-of-the-envelope hydrogen estimate, we will take the 30 BCF/day gas currently used for electric power and assume no growth for 2050. This gives 30 BCF/day of natural gas energy to be replaced. Recalling that the energy content of hydrogen is about 30% that of natural gas means that we need 3.3 CF of hydrogen to replace 1 CF of natural gas.

Doing the math and rounding, we need to 100 BCF/day or 240 million kg/day or 260 thousand tons/day of hydrogen.

With 80% efficient electrolysis, we need 49.3 kWh to produce 1 kg of hydrogen. That would be 11,800 GWh / day. Assuming a 20% capacity factor for solar, that would require 2,370 GW of solar capacity devoted to hydrogen production.

If you assume the IEA Reference case of 30% growth, it would be about 3,100 GW of solar.

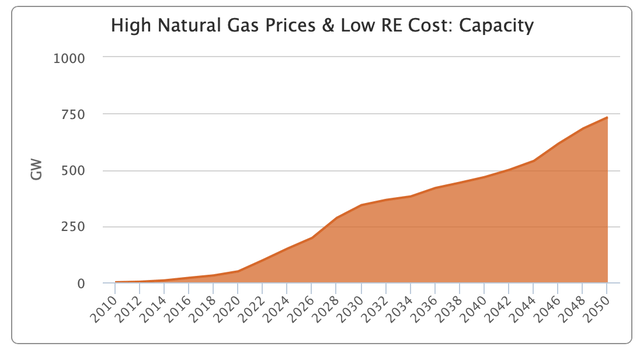

The National Renewable Energy Agency provides an interactive model that estimates capacity and generation out to 2050 for a number of scenarios. The figure below shows 733 GW of U.S. utility scale solar capacity in 2050, for high natural gas and low renewable energy costs. Bloomberg NEF makes a similar estimate for U.S. 2050 solar capacity. The Baseline Technology estimate, not shown here, is 525 GW of solar.

Source: NREL Scenario Results Viewer

The 2,370 GW of additional dedicated solar is 3.2 times the currently projected 2050 solar capacity, 4.5 times the NREL baseline projection. It's a very large amount of utility scale solar.

I would assess the required build out of the electrolysis and solar capacity to fully replace natural gas for electric power generation as unlikely. And even if this was achieved, it would still leave untouched the other 64% of natural gas that currently goes to other uses.

Analysis

I'd like to make four points here.

First, displacement of natural gas for grid power is not currently the primary target of hydrogen efforts. IHS Markit recently noted:

in the US and in Asia, the primary focus is simply transport. In mainland China, Japan and South Korea, a combination of local and central government works with industry to drive development of fuel cell vehicles and the associated infrastructure.

In Europe, there is interest in transport, but there are many other projects underway to look at the use of hydrogen ... in buildings, industry and power.

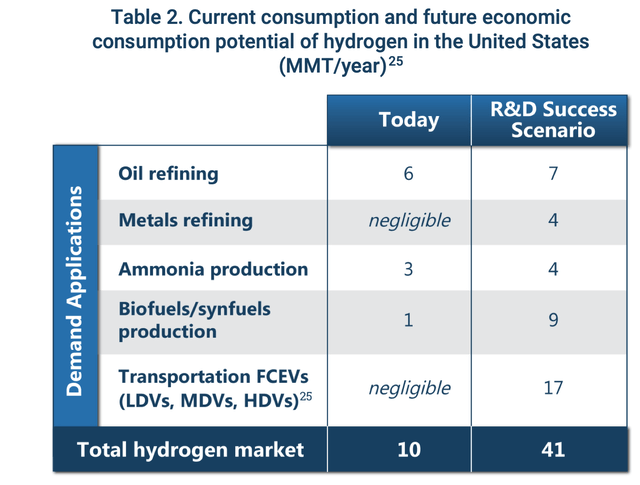

For example, the U.S. Department of Energy's 2020 Hydrogen Program Plan envisions increased hydrogen use primarily in transportation.

Source: U.S. Department Of Energy 2020 Hydrogen Program Plan

The Leeds City Gate Project illustrates a path to move the point of carbon displacement or capture from the residential water heater to the centralized gas plant, while preserving the gas network's current seasonal storage capability. There are also advantages to a mixed gas and electric infrastructure; it's an advantage to be able to heat your house and your food even if power is down.

Second, a very large amount of input energy is required to generate the amount of green hydrogen required to displace current natural gas used for electrical generation. We estimated above ~ 2,370 GW of dedicated U.S. solar capacity.

Considered against the projected 525-733 GW of U.S. utility scale solar, the use of "excess" solar capacity to produce hydrogen for the grid is only going to be a minor factor at best.

Third, hydrogen in grid relevant amounts requires a huge amount of electrolysis capacity. Our back-of-the-envelope case for the U.S. would require about 500 GW of electrolysis running 24/365, or about 1200 GW running on a 10 hour solar day. It would require many years to build that capacity at current manufacturing rates. And the U.S. is not the only market.

Fourth, there is a considerable decarbonization effort going on at the national and international level. This is likely to show up as both technical advances, standards setting, and regulation. The discussions at the October 2020 International Renewable Energy Agency conference give a good indication of the scope of this effort.

Things to Keep an Eye On

Thirty years is a long time. It would be prudent to revisit this analysis in five years or so. If hydrogen is going to be really significant by 2050, it should be much more evident by then. What kind of things might one look for?

Germany. Germany reportedly has the largest number of power to gas projects today. With significant intra-German power transmission issues as renewables reach high levels of market penetration, hydrogen could serve as a buffer. This could provide a national scale pilot project.

The Mitsubishi Power Advanced Clean Energy Storage Project in Utah. This is the only project I know of trying to pilot grid scale hydrogen in the U.S. If this is commercially operating, it should provide a great deal of hard data on real-world operational and cost performance.

Electrolysis scale up. It would be significant if a Global 500 firm (e.g. Siemens) is cranking out 100 GW a year of electrolysis capacity in an automated plant.

Commercialization of modular nuclear reactors. A viable near-term path to significant new nuclear power, perhaps factory built modular reactors, would reduce the push for hydrogen for the grid.

Commercial carbon capture. Commercially (effective, cheap) carbon capture would remove much of the motivation to displace natural gas.

Regulatory mandate. A de facto or de jure regulatory mandate (no natural gas used to generate electricity after 2045, for example, is already the current Renewable Portfolio Standard law in California).

Investor Takeaway

I think green hydrogen is technically feasible, and that costs will come down enough by 2040 or 2050, that a willingness to pay a 2-3x green premium will bridge any cost gap with natural gas. However, the scaling up required build and power the required electrolysis capacity makes it unlikely that hydrogen will displace a significant amount of the natural gas used to generate electricity by 2050. In any case, deployment before 2030 is likely to be very limited.

I consider myself a long term investor - ideally forever, but I seldom buy anything I don't plan to hold for 10 years. After spending time over the past couple of weeks looking into hydrogen and thinking about it, I'm personally comfortable maintaining my modest investments in natural gas - E&P, midstream, and gas utilities.

I might be wrong, and 30 years is a long time. It would be prudent to check back in 5 years. In the meantime, investments.

A large amount of energy would be required to generate the green hydrogen to replace natural gas. In the U.S. I think this would be largely solar in the U.S. (in most of Europe it might be largely wind). In our simple model above, we estimate it would require 3-4X above an already aggressive amount of utility scale solar. Solar investments that do well without hydrogen should do even better with it.

The actual turbine market is split among three very large players: Mitsubishi Power, Siemens, and GE. Whether their turbines continue to burn natural gas or transition to hydrogen over a couple of decades seems unlikely to move the needle.

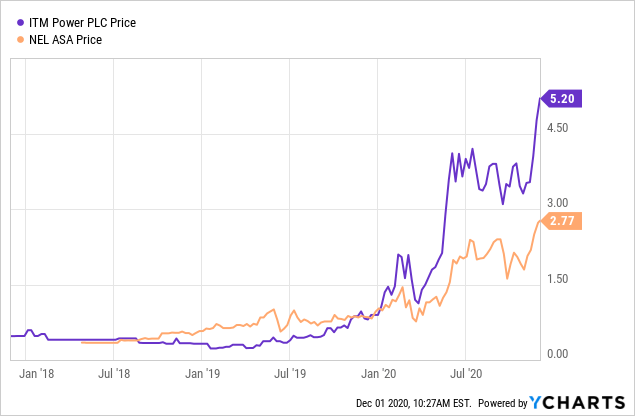

The highest alpha opportunity I see here is the electrolysis companies, like Nel ASA or ITM Power, although I would consider these very speculative. The potential market for hydrogen even outside the grid is large enough that someone should do well here. It appears from the chart below that other people think so as well.

I would consider all the electrolysis companies candidates for acquisition by large industrial firms - Mitsubishi, Siemens, etc.

Data by YCharts

Data by YChartsThis article was written by

Myers-Briggs ISTJ. Detail oriented, data driven, planner, long time horizon. Individual investor for 20 plus years. Did the CFP exam for grins years ago, but never certified. Interest in energy, tech.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4392471-hydrogen-vs-natural-gas-for-electric-power-generation

0 Response to "Natural Gas Power Generator Feed Gas Btucf"

Post a Comment